Saiba como resgatar dinheiro esquecido no banco

Aprenda como resgatar dinheiro esquecido no banco de forma rápida e simples. Confira o passo a passo para recuperar seus valores!

Agora que você já sabe como o processo funciona, é hora de aprender a resgatar dinheiro esquecido no banco. Para ajudar, elaboramos um passo a passo para fazer o resgate 100% online.

Antes de conferir o passo a passo, é importante lembrar que existem outras oportunidades para utilizar seu dinheiro conforme suas necessidades. Uma dessas chances é participando do programa Minha Casa Minha Vida. Com ele, você pode realizar o sonho da casa própria, dando adeus ao aluguel!

A seguir, você descobre como pode resgatar o dinheiro esquecido no Banco Central, além das regras para ter a chance de fazer o resgate!

Quem pode resgatar o dinheiro esquecido no Banco Central?

Assim como qualquer processo financeiro, existem algumas regras que você precisa seguir para poder fazer o resgate.

De maneira geral, qualquer pessoa ou empresa que possua um valor registrado no Sistema de Valores Reclamados (SVR) poderá resgatar seu dinheiro de maneira simples.

No entanto, há grupos específicos que precisam observar regras particulares para o resgate, sendo permitido para:

- Contas correntes ou poupanças encerradas com saldo disponível;

- Contas de capital e rateio de sobras líquidas de ex-participantes de cooperativas de crédito;

- Recursos não procurados de grupos de consórcio encerrados;

- Tarifas cobradas indevidamente;

- Parcelas ou despesas de operações de crédito cobradas;

- Contas de pagamento pré ou pós-paga encerradas com saldo disponível;

- Contas de registro mantidas por corretoras e distribuidoras encerradas com saldo disponível;

- Outros recursos disponíveis nas instituições para devolução.

Portanto, apenas se você se enquadrar em um dos casos mencionados acima terá um saldo disponível para resgate no Banco Central.

Documentos necessários

Uma das etapas fundamentais do processo de resgate é a apresentação dos documentos solicitados pelo banco.

Com a documentação fornecida, o Banco Central verificará a veracidade das informações apresentadas pelo usuário.

Embora esse processo seja essencial, os documentos solicitados são básicos e variam conforme o tipo de pessoa.

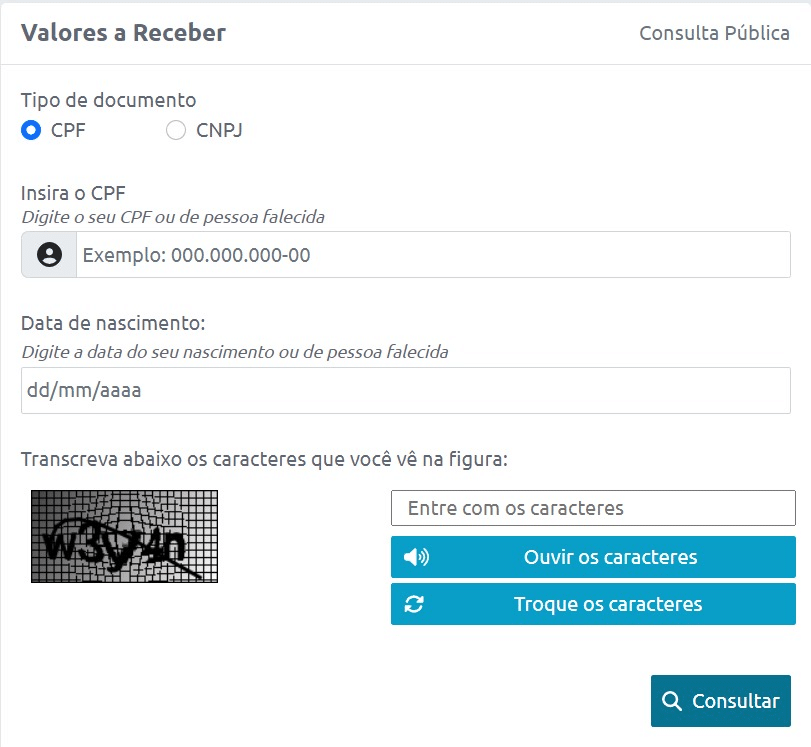

Por exemplo, no caso de uma pessoa física, é necessário apresentar o RG, CPF e data de nascimento para garantir o resgate.

Já para pessoas jurídicas, é indispensável a apresentação do CNPJ durante a consulta e o resgate.

Passo a passo de como resgatar o dinheiro esquecido no Banco Central

Agora, chegou a hora de aprender como resgatar o dinheiro esquecido no Banco Central de maneira simples.

A princípio, a instituição financeira disponibiliza um processo de resgate totalmente online, desde a solicitação até o pagamento. Dessa forma, você só precisa ter um dispositivo eletrônico com acesso à internet.

Embora o processo seja fácil, listamos as principais etapas para que você possa aprender da melhor forma a resgatar seu dinheiro. Confira o passo a passo!

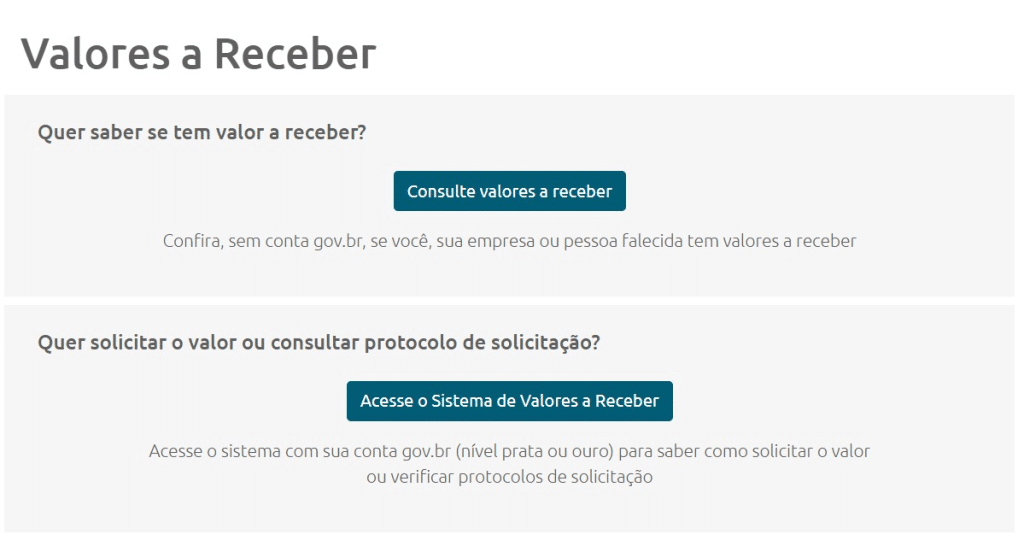

- Em seguida, selecione a opção “consulte valores a receber“;

- Na sequência, você deverá informar o seu CPF ou CNPJ (caso seja empresa) e data de nascimento;

- Então, faça a verificação de segurança e selecione a aba “consultar“.

- Na tela seguinte, você terá acesso às informações. Caso haja algum valor a ser recebido;

- Então, clique na opção “acesse o sistema de valores a receber“;

- Em seguida, você deverá logar com sua conta Gov.br;

- Feito isso, uma nova tela será aberta, onde você terá a opção de solicitar os valores a receber;

- Por fim, siga as orientações da página, forneça os dados da conta que receberá a transferência e finalize o processo.

Então, o Banco Central oferece uma forma de pagamento simples através do PIX, garantindo que você receba sua devolução de maneira rápida e fácil.